Robotics’ Next Billion-Dollar Battle Is in the Components

RealSense and others are proving that the big money isn’t in flashy humanoids, but in the chips, sensors, and actuators powering them

"A robot is not just a machine; it’s an integration of motors, sensors, and intelligence. Each piece must be world-class for the whole to matter." - Yoshiyuki Sankai

Humanoid robot demos often steal the spotlight. Watching a robot effortlessly pick boxes in a warehouse, delicately pour coffee, or mimic human gait is visually compelling and lends itself well to headlines. But peel back the curtain, and the real revolution is happening far beneath the surface, in the parts that give those machines sight, strength, and smarts. The future of robotics will be determined more by sensor chips than by showy full-body designs.

Intel’s recent decision to spin out its RealSense division exemplifies this shift. With nearly 60 percent of commercial autonomous mobile robots and humanoids already relying on RealSense depth cameras, the company now stands at a crossroads. Supported by a $50 million Series A round, the newly independent RealSense is free to redefine its path, pursuing partnerships across the robotics ecosystem and expanding into new markets, such as biometrics and security. By contrast, full-stack robot manufacturers must reinvent perception systems for every new model. The long-term winners will be the component providers whose technologies enable entire generations of robots.

Understanding the Power of Components

Historically, robotics mimicked the vertical integration of industries like the automotive sector: each company built sensors, control systems, mechanics, and software under one roof. That strategy worked when margins were high and systems simple, but it clashed with the complex, fast-paced era of modern robotics.

Today’s landscape is different. Startups, telepresence bots, surgical systems, and service robots all need similar building blocks, but with faster deployment cycles and tighter budgets. This has led to a revolution in modularity. A few suppliers now scale actuators, depth cameras, and chipsets across countless robot types.

NVIDIA doesn’t make robots, but its Jetson processors and Isaac software dominate the embedded AI stack. Harmonic Drive precision gears are used in both space-grade and industrial machines. Soft Robotics and XELA Robotics enable grippers with near-human sensitivity. RealSense, now competing in the same modular context, provides the “eyes” many robots rely on.

RealSense’s latest sensor, the D555, integrates depth perception with Power-over-Ethernet and on-device AI, enabling smarter and more responsive machines. Freed from Intel’s corporate cycles, RealSense is positioned to help define universal standards for sensing rather than serving a single corporate roadmap.

A Landscape of Component Providers

Component suppliers are quietly becoming the backbone of tomorrow’s robots. Depth cameras are evolving into integrated perception platforms, often including AI acceleration and networked connectivity. Motors and grippers are becoming more compliant and graceful, adopting human-inspired control. Edge AI processors are shifting inference and decision-making to the device level. Batteries, wireless charging, and energy management are optimized for continuous autonomous use.

While RealSense is a flagship leader, competitors like Luxonis with the OAK-D depth camera and XELA Robotics are hot on its heels. To support its leadership, RealSense holds more than 80 patents and serves a customer base exceeding 3,000 clients.

The hardware portion of the global robotics market remains dominant. As of 2024, hardware captured 63.8 percent of the total market share, even though software is projected to rise at a 23.6 percent CAGR through 2030, according to Mordor Intelligence. That hardware share spans sensors, actuators, power systems, and embedded AI chips, all of which underpin the robotics revolution.

Market Size and Growth in Hardware and Components

Consider these recent projections. The robotics industry is expected to grow from $53.7 billion in 2025 to $280 billion by 2034, a 20 percent CAGR. Hardware remains the primary driver, with sensors and actuators leading the charge.

RealSense’s move positions it to capture much of this value. By targeting both robotics and biometric markets, it ensures it is not solely reliant on one sector and can ride the rising tide of automation across industries.

A Global Lesson: Britain’s Vision for Component-Centric Robotics

A recent op‑ed by Dr Ingo Keller, Head of Robotics at the UK’s National Robotarium, argues that smaller nations like Britain should avoid the full-stack humanoid race and instead double down on component innovation. Keller warns that trying to “match the scale of complete system manufacturers” risks turning Britain into a footnote in robotics history. Instead, he urges the nation to amplify its strengths in precision engineering, research excellence, and technical know-how by specializing in high-value parts—such as sensors, mechanical units, and power systems—rather than pursuing entire humanoid platforms.

Keller’s argument echoes the rise of component-first champions, such as RealSense. By highlighting the economic and strategic benefits of focusing on critical subsystems, he reframes national ambition from flashy robots to fundamental innovation. His insight is that even if Britain doesn't build Tesla‑scale humanoids, it can still carve out global leadership by supplying the indispensable pieces inside them.

His point is underscored by stark statistics: the UK lags with only 119 robots per 10,000 industrial employees—near the bottom of the G7—while other nations surge ahead in automation adoption. Yet its robotics research remains top‑tier globally. The strategy, Keller suggests, should not be to subsidize humanoid prototypes, but rather to nurture clusters focused on precision parts, scalable testing infrastructure, and industry-aligned skills development.

This mirrors RealSense’s new path: by stepping away from full-stack robotics and evolving into a focused, well-backed sensor supplier, it is well positioned to supply myriad robot makers worldwide. It’s an approach that bridges Keller’s national robotics strategy with the global shift toward plug-and-play modularity: countries and companies can excel by owning and innovating key robot components.

The Context: Why Now for RealSense

The timing of this spin-out is no accident. Robotics investment is on track to exceed $200 billion by 2030, driven by industrial automation, e-commerce fulfillment, surgical precision, and other applications across various verticals. Humanoids alone grow at a pace above 40 percent annually, yet every autonomous robot needs reliable perception hardware.

Intel’s recent layoffs and refocusing on its core strengths left RealSense positioned to branch independently. The win is agility: a liberated RealSense can innovate rapidly, offer cross-platform integration, and align with IoT-driven and edge-first trends.

Freed from corporate alignment, RealSense can partner with previous competitors, ensuring that its sensors become universally available and adaptable. Its entry into biometrics, with the installation of 3D facial recognition kiosks in airports and stadiums, is another smart move to diversify application areas and revenue streams.

Potential Risks and Competitive Threats

The path forward is not without obstacles. Depth cameras are facing price commoditization as low-cost alternatives like the OAK-D proliferate. Expanding into biometrics and surveillance brings regulatory scrutiny. Global supply chain disruptions, particularly in rare-earth materials, could pose a threat to production. Recent U.S.–China trade tensions have already raised concerns about the potential for tariffs.

Despite these challenges, RealSense’s broad deployment base and deep patent portfolio suggest it has a protective moat, especially with over 3,000 current users.

Lessons for Robotics Innovators and Investors

For founders, engineers, or investors in robotics, the component war represents a paradigm shift. Instead of vertically integrating every subsystem, startups can collaborate with established hardware companies and build proprietary skills in software, autonomy, or UX.

This modularized approach dramatically shortens development cycles and lowers upfront capital requirements. It also invites standards-based ecosystems. A humanoid five years from now may be a chassis that carries RealSense eyes, NVIDIA brains, Harmonic Drive joints, and Soft Robotics fingers, assembled and customized in software.

Such interchangeability will resemble the modern PC or smartphone industries, where multiple firms compete at each layer but interoperate seamlessly.

In Closing

The next hero of robotics won’t be a single humanoid delivering groceries. It will be the sensor chips that enable sight. It will be the grippers and joints that allow gentle manipulation. It will be the edge AI that processes perception on-device in milliseconds. Intel’s RealSense spin-out sends a strong signal: the real power in robotics comes from the components, not the completed assembly.

The next time a robot demo wows you, ask yourself, “Who built its eyes? Its muscles? Its smarts?” That’s where long-term fortunes and the next leap forward will emerge.

Robot News Of The Week

Ex-Waymo engineers launch Bedrock Robotics with $80M to automate construction

Bedrock Robotics, a startup founded by former Waymo and Anki Robotics veterans, has emerged from stealth with an $80 million funding round led by Eclipse and 8VC. The company develops retrofit self-driving kits for construction and worksite vehicles, aiming to upgrade existing fleets with sensors, computing power, and autonomous intelligence that can run continuously and adapt to project goals.

Co-founder and CEO Boris Sofman—known for leading Waymo’s defunct self-driving truck program and co-founding Anki—heads a team that includes Waymo veterans Kevin Peterson (CTO) and Ajay Gummalla (VP of engineering), along with Tom Eliaz (VP of engineering) from Segment and Twilio.

Bedrock is testing its technology in Arkansas, Arizona, Texas, and California, partnering with companies such as Sundt Construction, Zachry Construction Corporation, Champion Site Prep, and Capitol Aggregates.

The startup joins a growing wave of companies bringing autonomous vehicle expertise to off-road environments, competing with firms like Pronto (which recently acquired SafeAI), Kodiak Robotics, Polymath Robotics, Overland AI, Potential, and Forterra.

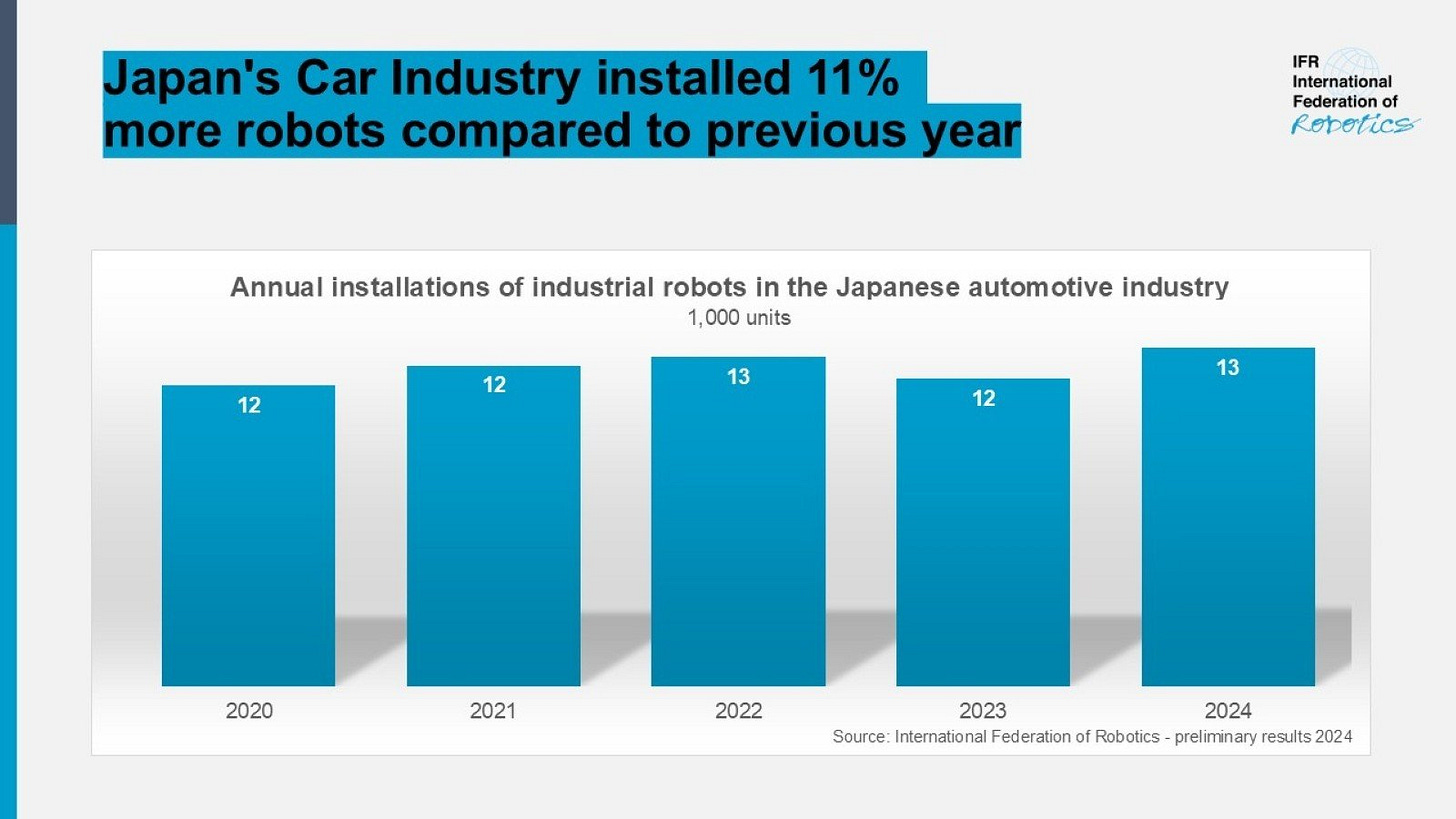

Japanese automotive industry hits five year high in automation

Japan’s automotive industry installed about 13,000 industrial robots in 2024, up 11% from 2023 and the highest level since 2020, according to the International Federation of Robotics (IFR). Japan remains the world’s top robot manufacturer, producing 38% of all robots globally, and ranks fourth worldwide in automotive robot density with 1,531 robots per 10,000 employees. The industry is restructuring to expand electric, fuel cell, and hydrogen-powered vehicles, requiring advanced automation; carmakers account for roughly 25% of Japan’s annual robot installations. Only the electronics sector installs more, though its numbers declined 5% to 14,000 units in 2024.

Globally, automation investments continue to rise. Europe installed 23,000 robots in 2024, with Switzerland leading in density at 3,876 robots per 10,000 workers. U.S. automotive installations grew 10.7% to 13,700 units, though most are imported. China dominates installations, averaging 280,000 per year between 2021 and 2023, now accounting for over half of global demand, and ranks third worldwide in manufacturing robot density at 470 robots per 10,000 workers, surpassing both Japan and Germany.

Robot Research In The News

Robots now grow and repair themselves by consuming parts from other machines

Robots may soon draw inspiration from biology. Researchers at Columbia University and the University of Washington have developed a process called “Robot Metabolism” that allows robots to grow, heal, and adapt by absorbing and reusing materials from their environment or even other robots.

Using Truss Links—simple magnetic modules inspired by Geomag toys—robots can self-assemble, morph into new shapes, and improve their capabilities. In one demo, a tetrahedron-shaped robot added an extra link as a “walking stick,” boosting its downhill speed by 66%.

Hod Lipson of Columbia calls this shift essential: “Robot minds have advanced through AI, but robot bodies remain rigid and unadaptive. Like biology, robots must learn to reuse parts from other robots.”

The team envisions self-sustaining robot ecologies, crucial for disaster recovery, space exploration, and other remote tasks. Philippe Martin Wyder adds, “Robot Metabolism gives AI a physical dimension of autonomy—robots that can literally take care of themselves.”

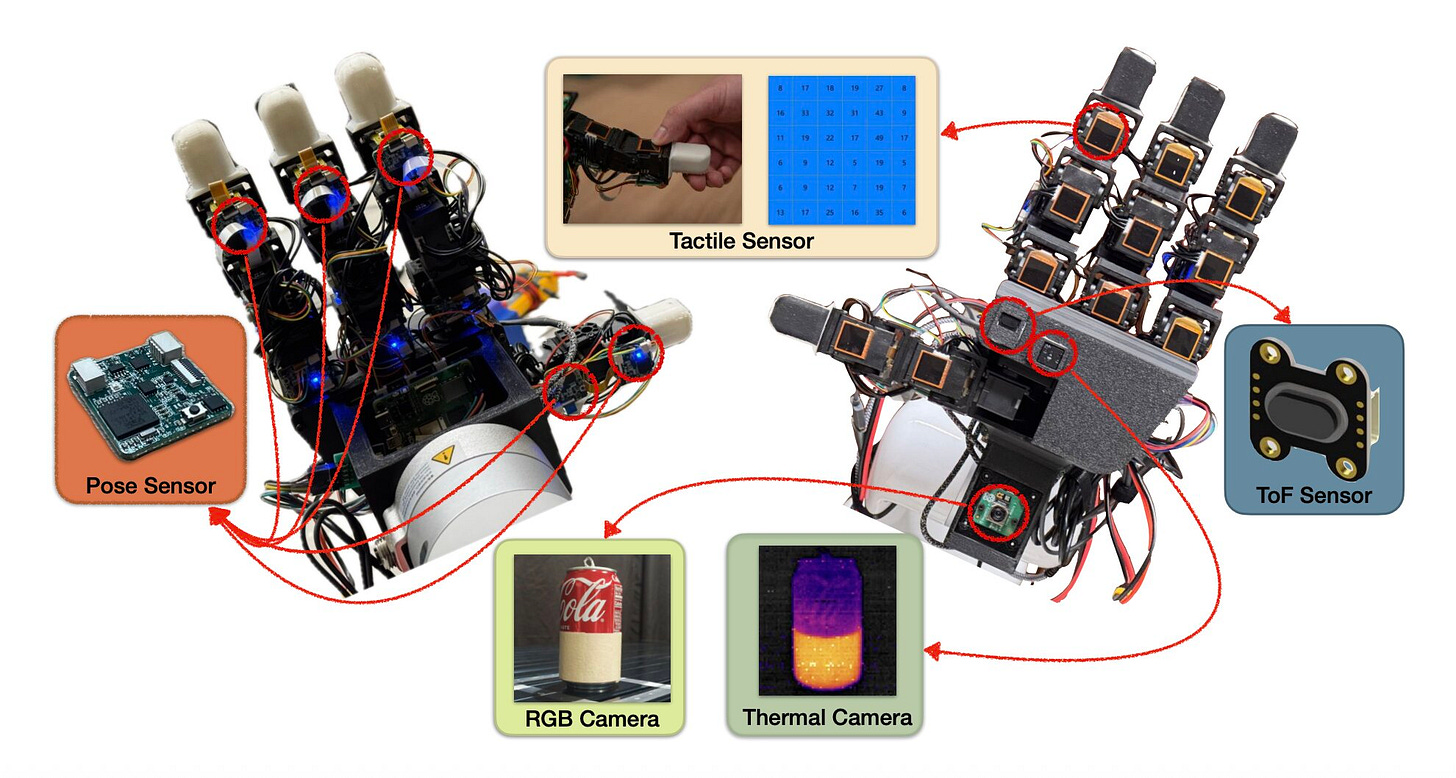

Dexterous robotic hand integrates thermal, inertial and force sensors

Most robots still lack the dexterity and sensory abilities of humans, which limits their performance in tasks such as disaster cleanup, household chores, and industrial maintenance, especially in high-temperature environments where precision and safety are critical.

Researchers at the University of Southern California have developed the MOTIF (Multimodal Observation with Thermal, Inertial, and Force sensors) hand, designed to improve robotic manipulation by integrating multiple sensing modalities. The MOTIF hand combines thermal, tactile, depth, RGB visual, and inertial (IMU) sensors, extending the widely used LEAP hand design to provide enhanced environmental awareness, safe handling of hot objects, and the ability to differentiate objects with similar appearances but different physical properties.

In lab tests, MOTIF successfully avoided hot surface areas when grasping objects and classified objects of identical shape but different weight using fingertip flick motions and inertial sensing. The combination of thermal sensing and 3D reconstruction enabled safer grasping, while multimodal inputs improved precision in handling tasks.

Potential applications range from household chores and professional kitchens to industrial work like welding or screw-tightening, where temperature and force estimation are crucial. Future plans include adding high-resolution fingertip sensors for finer tactile feedback and testing in more complex real-world environments.

The research team presented MOTIF at ISER 2025, encouraging further exploration of multimodal sensing in robotic hands.

Robot Workforce Story Of The Week

International STEM Students Are Turning Away From the U.S.

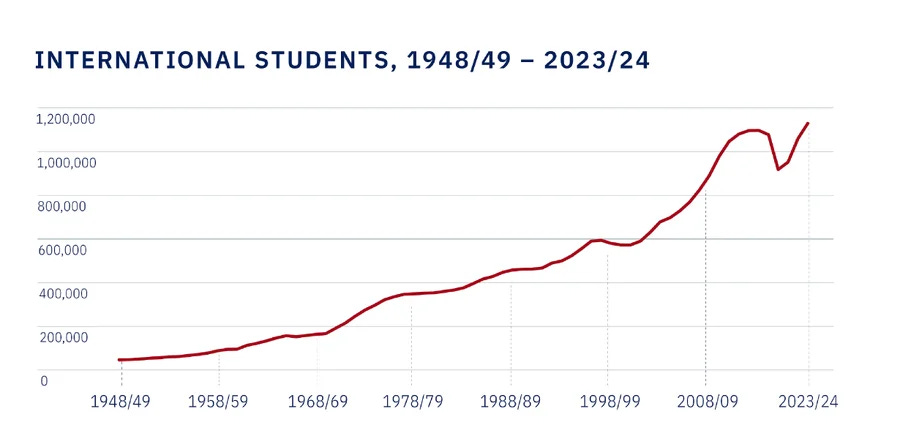

The United States has long been the top destination for international STEM students, but recent policy shifts and global competition are eroding that lead. Under the Trump administration, visa revocations, interview freezes, and heightened scrutiny—especially for Chinese students—triggered a sharp decline in interest that experts warn could last for decades.

Data from Studyportals shows a 50% drop in interest for U.S. degree programs from January to April 2024, with engineering bachelor’s inquiries down 41% and master’s down 36%. Subfields such as aerospace, automotive, and robotics saw the steepest declines. IDP, another placement organization, reports students are now favoring the U.K., Canada, Australia, China, and Germany.

This decline comes despite the U.S. hosting a record 1.1 million international students in 2023-24, 56% in STEM fields. International students are critical to U.S. innovation—70% of AI-related graduate students are foreign-born, and 42% of top U.S. AI companies were founded by former international students. Economically, they contributed $34.8 billion last year, helping subsidize domestic students.

Critics like U.S. Vice President JD Vance argue for prioritizing American students, but experts counter that international talent fuels research, startups, and economic growth. Meanwhile, competitors like Germany and China are aggressively recruiting, offering incentives such as free tuition.

“Reputation takes decades to build and can be lost overnight,” warns Clay Harmon of the Association of International Enrollment Management. “Every student who chooses London or Berlin over Boston is a lost opportunity for America’s future.

Robot Video Of The Week

Imagine a humanoid robot that walks like us, and never needs to take a break.

UBTECH’s Walker S2 is pushing industrial robotics forward with autonomous battery swapping for true 24/7 operations. Anthropomorphic bipedal locomotion + hot-swappable batteries = continuous work across dynamic industrial environments.

Swarm Intelligence 2.0? Can’t wait to see what’s next!

Upcoming Robot Events

Aug. 17-21 Intl. Conference on Automation Science & Engineering (Anaheim, CA)

Aug. 25-29 IEEE RO-MAN (Eindhoven, Netherlands)

Sept. 3-5 ARM Institute Member Meetings (Pittsburgh, PA)

Sept. 15-17 ROSCon UK (Edinburgh)

Sept. 23 Humanoid Robot Forum (Seattle, WA)

Sept. 27-30 IEEE Conference on Robot Learning (Seoul, KR)

Sept. 30-Oct. 2 IEEE International Conference on Humanoid Robots (Seoul, KR)

Oct. 6-10 Intl. Conference on Advanced Manufacturing (Las Vegas, NV)

Oct. 15-16 RoboBusiness (Santa Clara, CA)

Oct. 19-25 IEEE IROS (Hangzhou, China)

Oct. 27-29 ROSCon (Singapore)

Nov. 3-5 Intl. Robot Safety Conference (Houston, TX)

Dec. 11-12 Humanoid Summit (Silicon Valley TBA)