VCs Love Robotics, Until They Don't

Robotic Firms Are Getting The Most Love From VCs In 2024, Expect Those That Are Not

Aaron’s Thoughts On The Week

"Success is not final, failure is not fatal: It is the courage to continue that counts." — Winston Churchill

Venture capital (VC) funding in the robotics sector has seen a significant pullback, creating a challenging environment for startups in the field. The decline in funding is part of a broader trend affecting the tech industry, but it has hit robotics particularly hard due to the high costs and long development cycles associated with bringing robotic technologies to market.

There Was a Pullback in 2023, but 2024 is Different

In 2023, venture capital investments in robotics dropped to $10.6 billion, down from $18.5 billion in 2022. This reduction has been attributed to several factors, including market corrections and a shift in investor focus toward more mature, revenue-generating companies. The autonomous vehicle sector, once a darling of VC funding, saw a dramatic decrease, with investments plummeting from $9.7 billion in 2021 to just $2.2 billion in 2023. However, as of June 2024, the robotics industry, particularly in the autonomous vehicles (AV) segment, experienced a significant boom in funding with robotics investments for the first six months of 2024 already totaling about $8.4 billion. This marks a substantial increase compared to the same period in 2023 and 2022. In 2023, the robotics industry saw a total of $10.6 billion in venture capital investments for the entire year, with the AV sector experiencing a sharp decline, contributing only $2.2 billion. This was a significant drop from the $18.5 billion invested in 2022, where the AV sector had raised $9.7 billion.

In 2024, venture capitalists are showing strong interest in specific areas within the robotics sector, particularly those that align with AI integration, automation, and vertical applications. Some key areas where VC investments are flowing include:

Workplace Automation and Robotics: Companies that develop robots to automate tasks in workplaces, such as warehouses, agriculture, and manufacturing, continue to attract significant funding. Notable examples include Bright Machines, which raised $106 million for its factory automation technology, and Collaborative Robotics, which secured $100 million for its cobots that work alongside humans in industrial settings.

Autonomous Vehicles (AV): As already mentioned, the AV sector has seen a resurgence in 2024, with a massive $27 billion in funding by June. This marks a dramatic recovery after a significant downturn in 2023. Investments are being directed towards companies developing autonomous driving technologies and logistics solutions, reflecting renewed confidence in the sector's potential.

Humanoid Robots: Humanoid robotics is also gaining traction, with startups like Figure and 1X receiving large investments to develop general-purpose humanoid robots capable of performing complex tasks in various industries. This seems to be the riskiest of all of the type of robots to be investing in. However, never say that VCs sometimes just jumps on things because it looks “cool.” Do we all remember Juicero?

Surgical Robotics: The medical field continues to be a hotbed for robotics innovation. Companies like MMI and Ronovo Surgical have attracted significant investments to advance robotic-assisted surgical technologies, which promise greater precision and new treatment possibilities.

As the robotics industry continues to evolve in 2024, venture capitalists are strategically placing their bets on sectors with the most potential for growth and impact. While the autonomous vehicles (AV) segment has rebounded strongly, drawing significant investment, other areas like workplace automation, humanoid robots, and surgical robotics are also attracting considerable attention. This diverse focus highlights a broader recognition of robotics as a critical component of future innovation, addressing everything from labor shortages to complex medical procedures. However, it also serves as a reminder that while some investments are driven by solid market potential, others might be swayed by the allure of the "next big thing," as seen in past cautionary tales like Juicero.

Those Left Out In The Cold

The robotics startup ecosystem has seen a series of high-profile closures in recent months, largely due to a sharp decline in venture capital (VC) funding. Despite having innovative technologies and significant potential, many companies have found it increasingly difficult to secure the necessary financial backing to sustain their operations.

One of the notable casualties is Dextrous Robotics, which specialized in robotic manipulation and automated material handling. The firm located itself in Memphis, Tennessee to be close to logistics firms like FedEx that would be a target customer. The company, despite its promising technology, was forced to shut down after failing to attract further investment. This closure highlights the challenges even well-regarded startups face in a market where investors are becoming increasingly cautious.

Similarly, PrecisionHawk, a company known for its advanced commercial drone technology, also closed its doors. PrecisionHawk had been a leader in the drone space, offering solutions for a wide range of industries, including agriculture and energy. However, like many others, it struggled to secure additional funding amidst a tightening VC environment, leading to its shutdown.

The agricultural technology sector has not been spared either, with Small Robot Company being another unfortunate example. Despite its innovative approach to farming with small, autonomous robots designed to reduce the environmental impact of agriculture, the company was unable to continue operations due to a lack of funding. This is reflective of a broader trend where even startups with strong environmental and social value propositions are struggling to survive without sustained financial support.

These closures are part of a larger trend that also saw companies like Ready Robotics and others exit the market due to similar financial difficulties. Ready Robotics, known for its ForgeOS platform that aimed to simplify the deployment of industrial robots, was another victim of the current funding squeeze. The company’s shutdown underscores the harsh reality that even technologies designed to make robotics more accessible can falter when financial resources dry up.

These recent shutdowns illustrate the volatile nature of the robotics industry, where innovative ideas alone are not enough to guarantee survival. The need for substantial and sustained investment is critical, and as VC funding becomes more selective, many promising startups may continue to face existential threats.

What Does This All Mean

Being in a robot startup is not for the faint heart. One can do everything right, but just having one key ingredient to success can be all that it takes to lead to having to shut one’s doors. It sucks and it happens to some great companies with great ideas. They just run out of time, which in most cases is tied to how long the money will last in the bank account.

The failure rate of tech startups is notoriously high. Studies and industry experts estimate that approximately 90% of startups fail, with only about 10% succeeding. This statistic encompasses startups across various industries, including tech.

Within this high failure rate:

About 20% of startups fail within the first year.

30% fail within the second year.

Approximately 50% fail by the fifth year.

70% of startups have typically failed by their tenth year.

Now throw in how complex and difficult robotics is and how they are in most cases BOTH part HARDWARE startup and SOFTWARE startup, the chance for failure is going to be the most common outcome.

We haven’t even touched on the firms that sort of limp out of existence by getting acquired by larger better funded firm. Some may say these are still wins (even though small) while others still label them as fails. Symbotic, a publicly traded company, recently acquired VEO Robotics for $8.7 Million. The issue is that VEO Robotics had over its life had raised $57 Million from VCs. So is that a successful exit?

Personally, I think we will see VC deals to continue in the robotics industry. However, I think expectations from both founders and VCs need to get a bit more of a reality check. Founders need to really do their homework and ensure they are making something that the market needs. While VCs need to understand that robotic firms are going to need much longer runways than the “traditional tech” company. Also, VCs need to do their own due diligence and ensure they are investing in companies that are actually making products the market needs.

TL;DR

The robotics industry has faced a tough landscape with a significant downturn in venture capital (VC) funding. In 2023, investments dropped to $10.6 billion from $18.5 billion in 2022, as investors focused on more mature companies with immediate revenue potential. The autonomous vehicle sector was hit hardest, with funding plummeting from $9.7 billion in 2021 to just $2.2 billion in 2023. However, 2024 has shown a resurgence in the industry, especially in autonomous vehicles, which reached $27 billion in funding by June. Other areas like workplace automation, humanoid robots, and surgical robotics are also attracting increased investor interest.

Despite this renewed focus, the environment remains challenging for many startups. Companies like Dextrous Robotics and PrecisionHawk, known for their robotic manipulation and drone technologies, respectively, were forced to shut down due to funding shortages. The agricultural tech sector also suffered with the closure of Small Robot Company, despite its innovative approach to autonomous farming. These closures underscore the volatile nature of the robotics industry, where even the most promising startups struggle without sustained financial backing. As VC funding becomes more selective, the need for strong, ongoing investment is crucial to turning innovative ideas into viable businesses.

Robot News Of The Week

RoboGeorgia brings industry, academia, and robotics startups together in Atlanta

RoboGeorgia is a new initiative launched in Atlanta to unite industry, academia, and robotics startups, fostering collaboration and innovation in the robotics sector. The initiative aims to make Georgia a hub for robotics by promoting partnerships, supporting startups, and creating opportunities for research and development. By bringing together diverse stakeholders, RoboGeorgia seeks to accelerate the growth of the robotics ecosystem in the state, driving economic development and positioning Georgia as a leader in the robotics industry.

Tampa-area hospital completes first robot-assisted coronary artery bypass surgery

A Tampa-area hospital has successfully completed its first robot-assisted coronary artery bypass surgery, marking a significant advancement in medical technology and patient care. The use of robotic assistance in this procedure offers greater precision, smaller incisions, and faster recovery times compared to traditional methods. This milestone highlights the growing adoption of robotics in healthcare, enhancing surgical outcomes and improving patient experiences. The successful surgery reflects the potential for robotics to revolutionize cardiac care and other complex medical procedures.

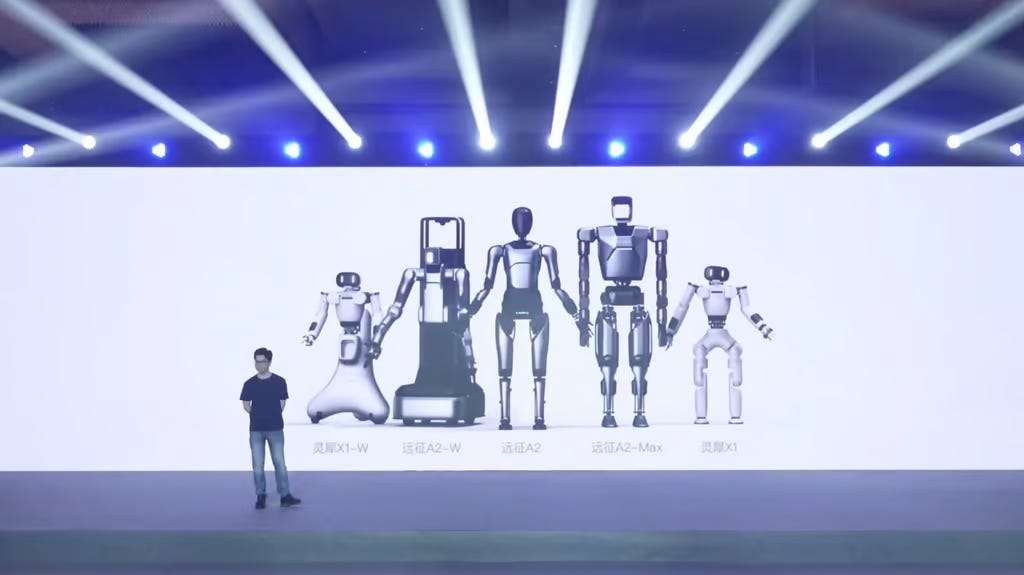

Former Huawei ‘Genius Youth’ recruit launches humanoid robots to rival Tesla’s Optimus

A former "genius youth" recruit from Huawei has launched a new company focused on developing humanoid robots to rival Tesla's Optimus. The company aims to create advanced robots that can perform complex tasks, leveraging cutting-edge AI and robotics technology. This venture reflects the growing competition in the humanoid robot market, with companies racing to develop robots capable of assisting in various industries. The founder's background in Huawei's talent program underscores the high level of expertise and innovation driving this new enterprise, positioning it as a potential leader in the field.

MassRobotics Accelerator opens to second round of startup applications

MassRobotics has opened applications for the second cohort of its Robotics Startup Accelerator program. This initiative aims to support early-stage robotics companies by providing resources, mentorship, and networking opportunities to help them grow and succeed. Selected startups will gain access to industry experts, potential investors, and a collaborative community, fostering innovation in the robotics field. The program reflects MassRobotics' commitment to nurturing the next generation of robotics companies and advancing the robotics ecosystem.

Robot Research In The News

The National Science Foundation (NSF) has announced the establishment of four new Engineering Research Centers (ERCs) to advance critical technologies and innovation. These centers will focus on areas such as precision microbiome engineering, sustainable water treatment, brain-inspired computing, and resilient cities. Each ERC will unite academia, industry, and government to drive breakthroughs that address national challenges, aiming to enhance U.S. competitiveness and improve quality of life. The NSF's investment highlights its commitment to fostering interdisciplinary research and developing the next generation of engineers and scientists.

Researchers train a robot dog to combat invasive fire ants

Researchers in Australia have developed a robot dog equipped with thermal vision and AI to combat invasive fire ants. The robot can detect ant nests by identifying heat signatures, helping to control the spread of these destructive pests. This innovation aims to protect agriculture and ecosystems from the significant damage caused by fire ants, providing a more efficient and effective solution than traditional methods. The project reflects growing interest in using robotics and AI to address environmental challenges.

Robot Workforce Story Of The Week

West Virginia University (WVU) preps for rollout of robotics engineering degree

West Virginia University (WVU) is preparing to launch a new robotics engineering degree program. The program aims to equip students with the skills needed to excel in the rapidly growing field of robotics, combining coursework in engineering, computer science, and hands-on experience. This initiative responds to increasing demand for robotics expertise in various industries and positions WVU as a leader in robotics education. The new degree program is expected to attract students interested in cutting-edge technology and contribute to the development of the next generation of robotics professionals.

Robot Video Of The Week

The title of this video is “Silly Robot Dog Jump,” and honestly, that’s already more information than you probably need.

Upcoming Robot Events

Sept. 9-14 IMTS (Chicago, IL)

Oct. 1-3 International Robot Safety Conference (Cincinnati, OH)

Oct. 7 Humanoid Robot Forum (Memphis, TN)

Oct. 8-10 Autonomous Mobile Robots & Logistics Conference (Memphis, TN)

Oct. 14-18 International Conference on Intelligent Robots and Systems (Abu Dhabi)

Oct. 15-17 Fabtech (Orlando, FL)

Oct. 16-17 RoboBusiness (Santa Clara, CA)

Oct. 21-23 ROSCon (Odense, Denmark)

Oct. 28-Nov. 1 ASTM Intl. Conference on Advanced Manufacturing (Atlanta, GA)

Nov. 22-24 Humanoids 2024 (Nancy, France)

Jan. 21-24 Intl. Symposium on System Integrations (Munich)

Mar. 4-6 Intl. Conference on Human-Robot Interaction (Melbourne)

Mar. 21-23 Intl. Conference on Robotics and Intelligent Technology (Macau)

May 12-15 Automate (Detroit, MI)

May 17-23 ICRA 2025 (Atlanta, GA)

May 18-21 Intl. Electric Machines and Drives Conference (Houston, TX)

May 20-21 Robotics & Automation Conference (Tel Aviv)

Aug. 18-22 Intl. Conference on Automation Science & Engineering (Anaheim, CA)